The Green Side of Green: How Going Vegan or Vegetarian Can Bolster Your Bank Balance

Choosing a vegan or vegetarian lifestyle is often associated with environmental sustainability and improved health….

Money management and savings is a vital aspect of personal finance, but it’s often neglected in our busy lives. Automatic savings can provide an effective solution, requiring minimal effort while yielding impressive results over time. This strategy revolves around setting up recurring transfers from your checking account to your savings or investment accounts. Let’s delve…

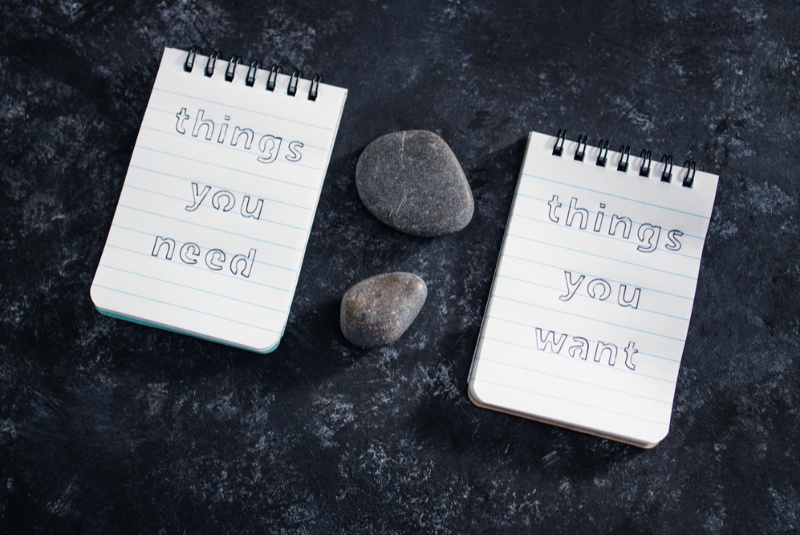

Financial literacy is an essential life skill that everyone should strive to master. It is the backbone of responsible money management, guiding how one budgets, invests, and plans for the future. A cornerstone of financial literacy is understanding the difference between wants and needs – a distinction that can drastically alter one’s financial landscape. “Needs”…

In today’s fast-paced world, pets provide a source of companionship and unconditional love. However, it’s no secret that pet care can often feel like a financial juggle. Yet, being a pet owner doesn’t need to break the bank. Here are some practical tips to help you provide quality care for your pets while maintaining financial…

Becoming a parent is a joyful and transformative event. However, along with the bliss and joy, it can also bring about a significant financial challenge. To assist new parents, we have compiled essential money-saving tips to alleviate some of these financial pressures without compromising the quality of care for your little one. Prepare a Budget…

Renovating your home can be a rewarding yet financially demanding project. However, with a little strategic planning and creativity, you can accomplish a transformative home renovation without breaking the bank. Here’s how: Plan Ahead: A well-thought-out plan is the cornerstone of any cost-effective renovation. Identify the exact changes you want to make, estimate the cost,…

The college years are a transformative period in a person’s life, opening doors to new experiences, a diverse array of ideas, and a pathway to personal and professional growth. However, along with this exciting journey, students also face financial challenges, especially when it comes to saving money. If you’re a college student looking to better…

Financial literacy is one of the most crucial skills in the modern era. It encompasses a range of elements, and one that often proves puzzling to many people is the concept of interest rates. Understanding interest rates is key to managing personal finance effectively, allowing individuals to make informed decisions about saving, investing, and borrowing….

Fast food, with its convenience and immediate gratification, is a tempting choice for many. In the hustle of modern life, the promise of a hot, ready meal often outshines the effort required for home cooking. However, this instant gratification often masks the true cost of fast food—not just in monetary terms, but also considering health…

In today’s fast-paced digital era, credit card companies, retail businesses, and various service providers offer enticing cash back and reward programs to retain their customers and enhance spending habits. For the savvy consumer, these schemes can result in substantial savings and perks. The following guide explores strategies for maximizing your benefits from cash back and…

As we navigate the 21st century, harnessing renewable energy is becoming increasingly necessary for both environmental sustainability and financial prudence. One of the most accessible forms of renewable energy is solar power. If you’ve considered installing solar panels at your home or business, you’re on the right path. Solar energy not only reduces carbon footprints…