Choosing the right bank is essential for managing your finances efficiently. However, as your financial needs evolve, your current bank might no longer provide the services or benefits you require. If you’re unsure whether it’s time to switch banks, here are the key signs that indicate you should explore better options.

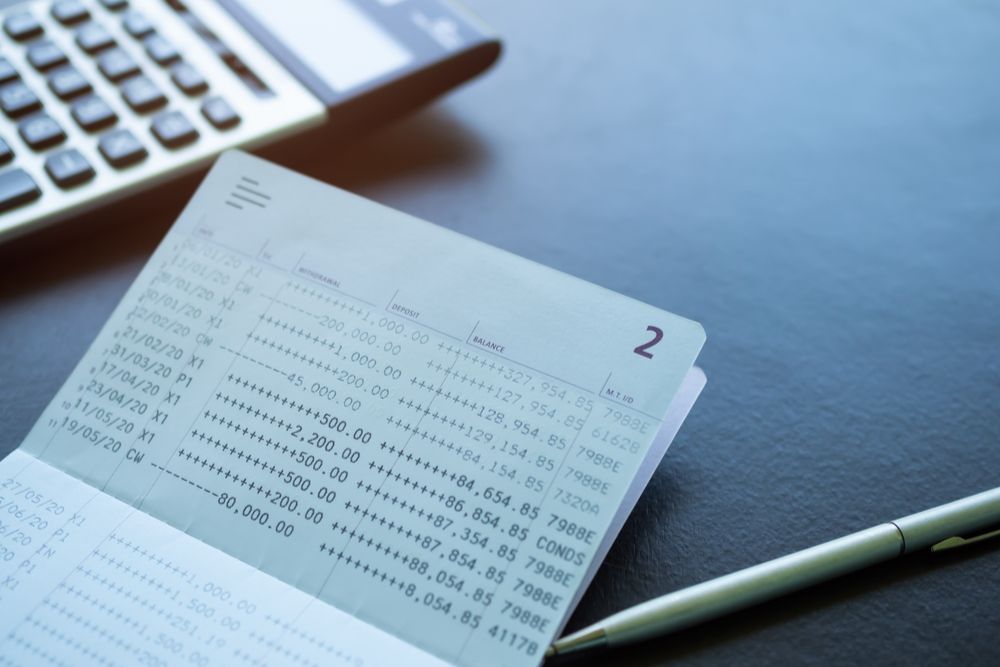

High Fees Are Draining Your Account

One of the biggest reasons to switch banks is excessive fees. Many traditional banks charge fees for maintaining low balances, ATM withdrawals, overdrafts, or wire transfers. If you’re finding it hard to avoid fees, it might be time to explore banks or credit unions that offer low-fee or no-fee checking and savings accounts.

What to Look For in a New Bank:

- Free checking accounts with no minimum balance

- Access to a broad ATM network without surcharges

- Fee-free overdraft protection options

Online-only banks often offer fee-free services and reimburse ATM fees, which could save you money in the long run.

Limited or Poor Customer Service

If you’ve experienced long wait times, limited support hours, or unhelpful customer service, it’s worth considering a bank that prioritizes better customer care. Look for banks that offer 24/7 support, responsive online chat options, and easily accessible branch locations if you prefer in-person service.

What to Look For in a New Bank:

- 24/7 phone or chat support

- Easy-to-use mobile apps for account management

- Positive reviews regarding customer service

Strong customer service ensures you can quickly resolve any financial issues, giving you peace of mind.

Outdated Technology and Limited Online Features

With the increasing importance of online and mobile banking, your bank must offer modern technology to meet your needs. If your current bank has an outdated mobile app, limited online banking features, or frequent technical issues, switching to a tech-forward bank could improve your banking experience.

What to Look For in a New Bank:

- Intuitive mobile apps with advanced features (e.g., budgeting tools, instant transfers)

- Mobile check deposits and digital wallets (like Apple Pay or Google Pay)

- Seamless online account opening and management

Many online and newer banks offer streamlined digital experiences, ideal for those who prefer to handle most transactions remotely.

Interest Rates Aren’t Competitive

If your savings account earns little to no interest, you’re missing out on potential growth. Many online banks and credit unions offer higher interest rates on savings accounts and certificates of deposit (CDs) compared to traditional banks. If your current bank offers minimal interest, it might be time to switch.

What to Look For in a New Bank:

- High-yield savings accounts with competitive rates

- Low or no minimum deposit requirements

- Automatic savings tools to help you grow your funds

A small improvement in interest rates can lead to significant savings over time, especially if you have a larger balance.

Limited ATM and Branch Access

If you travel frequently or live far from your bank’s branches and ATMs, limited access can become a hassle. Paying out-of-network ATM fees can also add up. Consider switching to a bank that offers broad ATM networks or reimburses fees for out-of-network withdrawals.

What to Look For in a New Bank:

- Access to nationwide or global ATM networks

- Free ATM withdrawals or fee reimbursements

- Shared branching services (common with credit unions)

Banks with robust ATM and branch networks ensure you can manage your finances conveniently, wherever you are.

Your Life Circumstances Have Changed

Life events like moving to a new city, getting married, or starting a business may require new financial services that your current bank doesn’t provide. If your bank lacks services like business accounts, investment tools, or mortgage assistance, it might be time to switch to one that aligns with your new financial goals.

What to Look For in a New Bank:

- Business checking or savings accounts if you’re an entrepreneur

- Mortgage or loan options for homeowners

- Investment and retirement planning tools

A bank that grows with your changing needs ensures you have all the financial tools necessary to succeed.

You Want Better Rewards or Perks

Some banks offer cashback rewards on debit card purchases or perks like travel benefits, discounts, or referral bonuses. If you’re not receiving meaningful benefits from your current bank, consider switching to one that offers more attractive rewards programs.

What to Look For in a New Bank:

- Cashback on debit card purchases

- Discounts on loans or credit products

- Referral bonuses or sign-up promotions

Many newer banks offer innovative perks, such as no-fee overdrafts or early paycheck access, which can provide added value.

You’re Concerned About Security and Fraud Protection

If your bank doesn’t offer strong security features, you could be vulnerable to fraud. Look for a bank that provides real-time fraud alerts, two-factor authentication, and identity theft protection. A secure bank gives you peace of mind when managing your finances.

What to Look For in a New Bank:

- Real-time alerts for suspicious activity

- Two-factor authentication for online accounts

- Zero liability protection for unauthorized transactions

Security should be a top priority when choosing a financial institution to protect your money and personal information.

You’re Not Satisfied with Your Bank’s Policies

Some banks have policies that don’t align with your values or lifestyle. For instance, you may prefer a bank that supports sustainable initiatives or community programs. If your current bank’s policies or practices don’t align with your priorities, it might be time for a change.

What to Look For in a New Bank:

- Credit unions that support local communities

- Banks with sustainability initiatives

- Ethical investment practices

Choosing a bank that reflects your values can make banking a more satisfying experience.

Switching banks can feel like a big decision, but it’s worth it if your current bank no longer meets your financial needs or expectations. High fees, outdated technology, poor customer service, or limited access are all signs that it might be time for a change.

Look for a bank that offers modern features, competitive interest rates, lower fees, and strong security. Whether you prefer the convenience of online banking or need access to in-person services, there’s a bank out there that fits your lifestyle. With the right financial partner, you can better manage your money and reach your financial goals more effectively.